How to Backtest a Dollar Cost Average Strategy

In this article, we will explore how to effectively backtest a dollar cost average (DCA) strategy and analyze its performance using historical data.

Dollar Cost Averaging is a popular investment approach that involves regularly investing a fixed amount of money into an asset or portfolio over time, regardless of its market price. This strategy aims to reduce the impact of market volatility and removes the need to time the market.

However, it is important to validate the effectiveness of a DCA strategy through backtesting. Backtesting allows investors to assess the performance of their strategy under various market conditions and evaluate its viability over time. It provides valuable insights into the potential risks and rewards associated with implementing a DCA approach.

We will use the Finzig Backtester in this guide. You find it under Finzig » Backtester.

In this article, we will guide you through the steps of backtesting a DCA strategy:

- Set up your portfolio

- Define your DCA frequency

- Account for transaction costs or fees that may impact trade execution

- Evaluate the backtesting results

A brief overview of Dollar-Cost Averaging and Backtesting

Just before we dive into the steps, let's take a moment to understand the concepts of Dollar-Cost Averaging and Backtesting.

Understanding Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves consistently investing a fixed amount of money into a particular asset or portfolio of assets, such as stocks or funds, at regular intervals over an extended period. This approach is based on the principle of spreading out purchases and reducing the impact of market volatility on investment returns.

Here are some key points to consider when understanding dollar-cost averaging:

- Consistent investments: With dollar-cost averaging, investors commit to investing a fixed amount of money at predetermined intervals, regardless of the asset's price. This strategy encourages disciplined investing and takes advantage of both high and low market prices.

- Reducing emotional decision-making: Dollar-cost averaging helps investors avoid making emotional decisions based on short-term market fluctuations. By investing regularly over time, investors can avoid the pitfalls of trying to time the market and make more rational investment decisions.

- Long-term thinking: Dollar-cost averaging promotes a long-term investment mindset by focusing on accumulating assets gradually over time. By staying invested for a longer duration, investors can potentially benefit from compounding returns and ride out market volatility.

- Lowering average cost per share: Since investments are made at regular intervals, dollar-cost averaging allows investors to buy more shares when prices are low and fewer shares when prices are high. This strategy can result in a lower average cost per share over the long term.

- Mitigating risk: Dollar-cost averaging spreads investments over time, reducing the impact of sudden market downturns. By consistently investing regardless of market conditions, investors effectively lower their exposure to short-term volatility.

The Importance of Backtesting Investment Strategies

Backtesting investment strategies is crucial for evaluating their performance and viability. Here's why it matters:

- Risk Mitigation: Backtesting allows you to assess how an investment strategy would have performed in the past, providing insights into its potential risk and return profile. By simulating historical market conditions, you can identify potential vulnerabilities and adjust your approach accordingly.

- Informed Decision-Making: Through backtesting, investors gain a deeper understanding of how their strategies would have fared in various market scenarios. This knowledge empowers them to make more informed decisions based on evidence rather than speculation or intuition.

Backtesting is a valuable tool for investors seeking to refine their portfolio management approach. It helps them uncover the strengths and weaknesses of their strategies, ultimately contributing to a more robust and effective investment process.

In this guide, we'll use Finzig's backtesting tool to demonstrate how to backtest a dollar-cost averaging strategy effectively. Finzig's platform provides a user-friendly interface for creating and testing investment strategies using historical data, making it an ideal choice for investors looking to optimize their portfolio management approach. Let's get started!

Backtesting a DCA strategy

Now, let's walk through the steps of backtesting a dollar-cost averaging strategy using Finzig's backtesting tool.

Step 1: Set up your portfolio

Head over to Finzig's Backtesting tool to follow along.

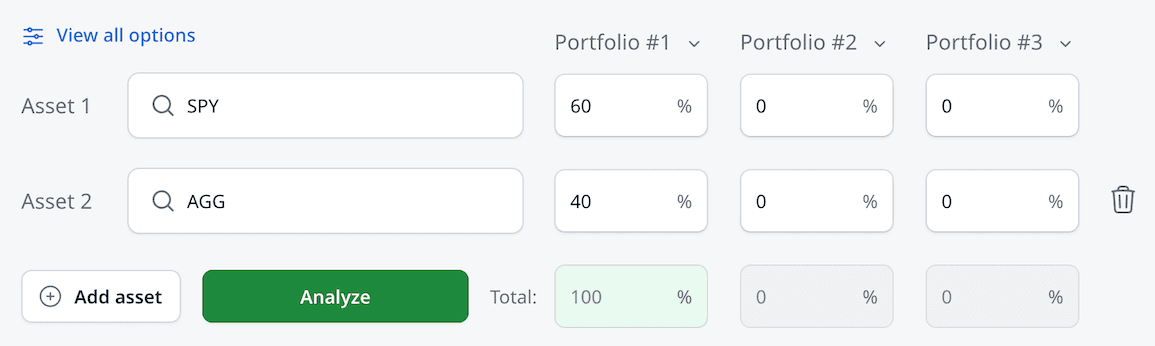

Let's first set up our asset allocation for the DCA strategy. For this example, we'll create a simple portfolio consisting of two assets:

- 60% S&P 500 (SPY)

- 40% US Aggregate Bond (AGG)

That should look like this:

Step 2: Define your DCA frequency

Determine the frequency of your investments (e.g., monthly, quarterly), as well as the amount you will invest each time.

The frequency of your investment depends on a few criteria. If you have a big lump sum that you are ready to invest but want to spread over a certain period, it may be good to spread this lump sum over a few months to a year. Longer than a year may not be so interesting since you are leaving cash on the table for a long period of time, while your money could have already start earning you more money. A too-short timeframe of e.g. 3 months may also not be ideal to take advantage of potential downward market movements. A monthly frequency over 6 months may be a good starting point in case of a big lump sum, but it is ultimately a personal choice depending on what is the most comfortable for you.

Not starting with a lump sum but just want to invest periodically? Leave aside a portion of cash to invest, perhaps on a monthly, quarterly or yearly basis, and you're off to a good start.

Are you not set on a frequency or amount? No worries, you have a backtesting tool in hand to use to test different frequencies and amounts which can help you see what performs the best.

Within the Options in the Backtesting Wizard, you can set your initial investment amount, and recurring investment amounts by frequency.

As an example, let's set up a scenario where we have 10,000 and then invest the remainder (1,000 every month for the next 10 months.

In the "Initial Capital" field, enter $10,000.

Then click on "Add Recurring Investment" and set the amount to $1,000 and the frequency to "Monthly" for 10 months.

Step 3: Account for transaction costs or fees

When backtesting a DCA strategy, it's important to consider transaction costs or fees that may impact the execution of trades. These costs can vary depending on the brokerage platform or investment vehicle you use.

In the Finzig Backtester, you can account for transaction costs by adjusting the "Transaction Costs" field in the Options section of the Backtesting Wizard. This allows you to simulate the impact of fees on your DCA strategy and evaluate its performance more accurately.

Step 4: Evaluate the backtesting results

Click on the "Analyze" button and you'll be taken to the portfolio analysis page where you can see the performance of your DCA strategy.

Here, you can view key metrics such as total return, annualized return, volatility, and drawdowns to assess the effectiveness of your DCA strategy.

You can also try comparing the performance of your DCA strategy to a benchmark asset, or run the backtest without DCA (without the recurring amounts).

Consider adjusting parameters of your DCA strategy (e.g., frequency, investment amount) and retesting to optimize performance.

It may also be useful to adjust the "Start Date" and "End Date" of the backtest to analyze the strategy's performance over different historical periods to assest its robustness under different market conditions.

Conclusion

Backtesting a dollar-cost averaging strategy is a valuable exercise for investors looking to evaluate the performance of their investment approach and optimize their portfolio management strategy. By simulating historical market conditions and analyzing key metrics, investors can gain valuable insights into the risks and rewards associated with a DCA strategy.

But always keep in mind that past performance is not indicative of future results. While backtesting provides a useful framework for assessing investment strategies, it's essential to consider other factors such as market conditions, economic trends, and geopolitical events when making investment decisions.