How to Use the Finzig Backtester to Backtest Your Portfolio

Finzig provides a backtesting tool that allows you to test and analyze the historical performance of your portfolio or assets. Although the tool is quite simple and intuitive, it can also be used for many advanced use cases. We thought we'd give you a rundown of all the capabilities that our backtest tool offers.

We'll start with the basics and then move on to more advanced features.

Backtest Wizard: Asset Allocation

Within our backtest wizard, we have two distinct sections, one is for setting the actual asset allocation, and the other are more advanced options that we'll cover later.

Analyzing an asset

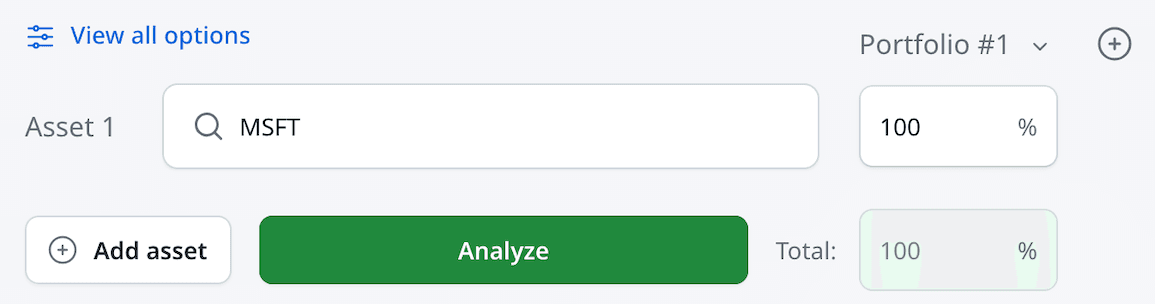

To analyze just one asset, enter the desired asset on "Asset 1" and set "Portfolio #1" to 100%. This will simulate a portfolio with only one asset.

Here we've entered Microsoft (MSFT) as the asset to analyze:

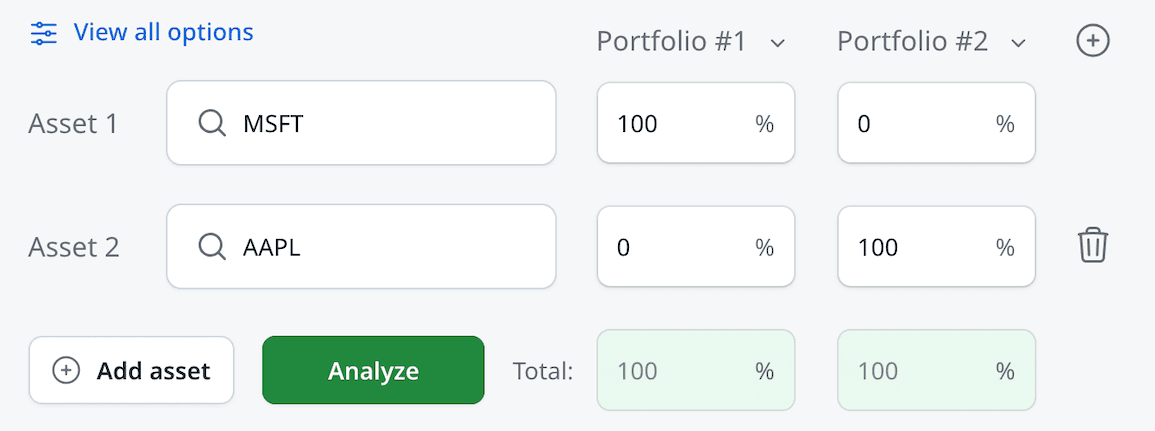

Comparing with another asset

To compare Microsoft with another asset, for example Apple (AAPL), click on the "Add asset" button to add a new row. Now search for Apple on "Asset 2". Finally, click on the "+" button to add a new portfolio, so that "Portfolio #2" becomes visible. You can then set it to 100% for Asset 1, while leaving it to 0% for Asset 1.

The end result should look like this:

Analyzing multiple portfolios

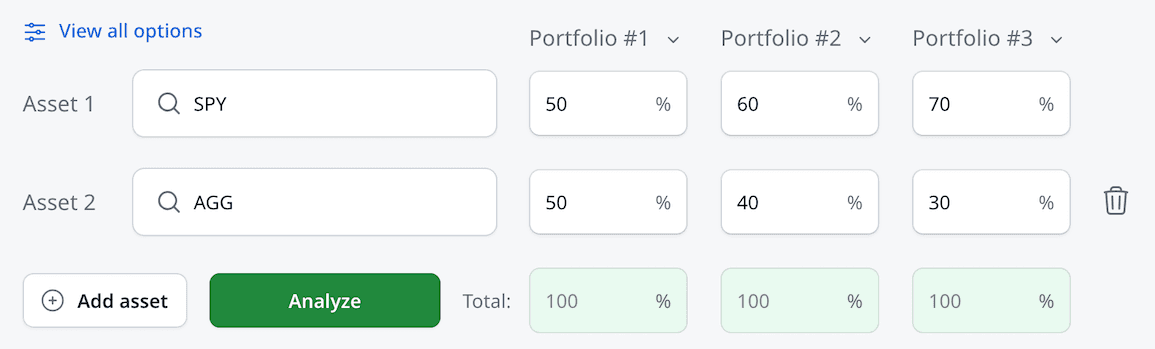

A portfolio usually consists of multiple assets, so while we've previously been adding only 1 asset per portfolio, we can simply add more assets to the same portfolio, and set the desired weights (percentages) for each asset, which should always add up to a total of 100%.

In this example we're interested in backtesting and comparing 3 similar, but different, traditional Stocks/Bonds portfolios. We'll use SPY (S&P 500 ETF) and AGG (US Aggregate Bond ETF) as the assets.

The first portfolio will consist of 50% SPY and 50% AGG, the second portfolio will consist of 60% SPY and 40% AGG, and the third portfolio will consist of 70% SPY and 30% AGG. As you can see, we are increasing the exposure to stocks (SPY) and decreasing the exposure to bonds (AGG) in each portfolio.

You can compare up to three portfolios at the same time. The number of assets within a portfolio is virtually unlimited.

Portfolio Allocation options

You might have noticed that down arrow next to the "Portfolio #x" label. Clicking on it will reveal a dropdown with more options to facilitate setting the weights for the portfolio in question:

- Reset all to 0: Set all assets within the portfolio to 0%. If all asset weights are set to 0%, the portfolio will be ignored.

- Equal Weight: Set all assets within the portfolio to have the same weight. This avoids having to calculate and repeat the same percentage for each asset manually.

Backtest Wizard: Options

The backtest wizard also offers more advanced options that can be used to further customize the backtest, which are revealed by clicking on the "View all options" button on top of the wizard.

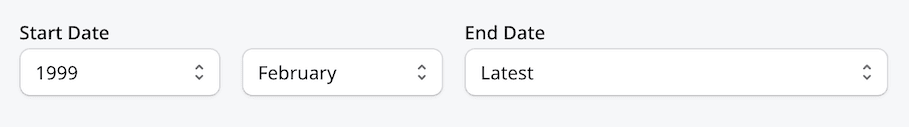

Setting the time period

By default, the backtest will run from the start of the available data until the most recent date. However, you can set a custom period using the "Start Date" and "End Date" fields. As you can see, by default, these are set to "Earliest" and "Latest" respectively.

You can change these by first selecting a year, and then also a month. E.g. if the start date was set to February 1999, the backtest would start from the first trading day of that month. Or at least, provided that the data for the asset(s) in question goes back that far.

Rebalancing

In case your portfolio consists of multiple assets, you can define how often the portfolio should be rebalanced. Rebalancing means that the weights of the assets are adjusted back to the original weights. This is done to maintain the desired asset allocation over time.

If you do not wish to rebalance your portfolio, you can pick the "None (Buy and Hold)" option.

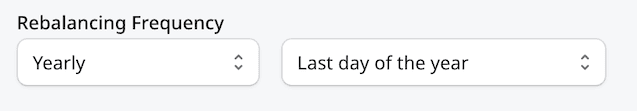

Otherwise, you can choose between Yearly, Quarterly, Monthly and Weekly. Once you've selected one of these options, you can also set the day when the rebalancing should occur.

Just keep in mind that these rebalancing options do not have any effect at all if you're only analyzing one asset.

That's it! Use your newfound skills in our backtesting tool. Happy Backtesting!